Table of Content

A home is a major purchase that can help to stabilize your finances. But using 401k to buy a house is not necessarily the right strategy. In fact, most should consider other options to fund their home purchase. If you can allow the funds to grow untouched, it is possible to build a substantial retirement account with time. Saving for retirement is a crucially important goal for a stable financial future. With that, pulling funds out of your 401k prematurely can negatively affect your long-term financial security.

Research what mortgages you may qualify for with lower down payments and whether you’ll qualify for home buying assistance. The federal government has many first-time homebuyer programs with lower minimum down payments and payment assistance programs. You should also check with your state’s local housing authority because each state has unique first-time homebuyer programs. These government-backed mortgages include programs for first-time home buyers and programs that target specific demographics. Even though sometimes it might be less costly to withdraw money from a 401, in many cases, it might be better to use PMI. PMI usually has an annual premium of around 0.5% to 1.5% of the principal amount.

Pros and Cons of Using a 401(k) to Buy a House

Researching grants – Some states, cities, and counties offer grant incentives for qualifying first-time home buyers. Depending on the nature of the grant, you may be able to use it for your down payment or closing costs. Perhaps you can easily afford the monthly payment on your dream home, but it’s the down payment that worries you. The down payment is the portion of the purchase price paid upfront, generally 3-10% for first-time home buyers. On top of that, you could pay another 3-6% of the purchase price in closing costs.

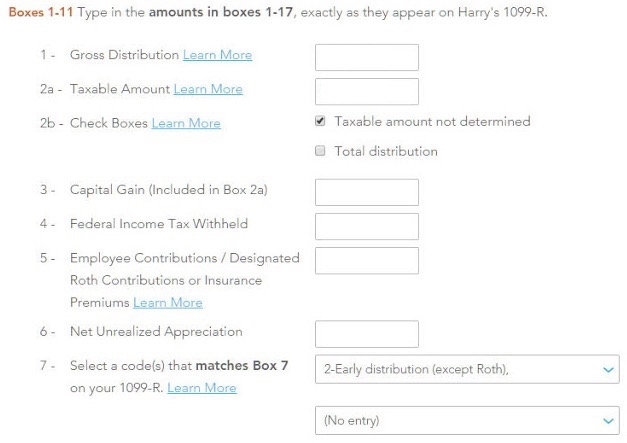

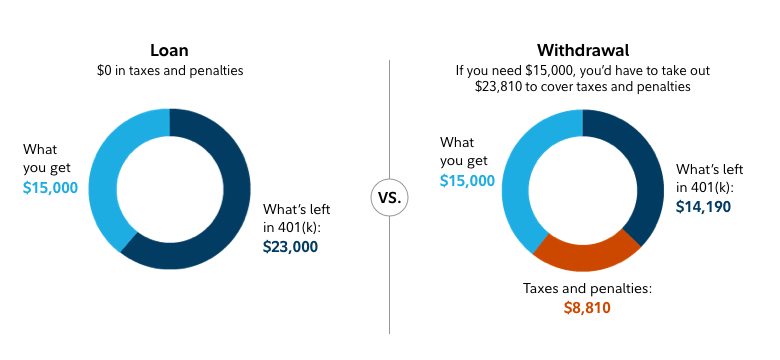

Let’s break down whether you should make a 401 withdrawal to buy a home and other alternatives. A financial advisor can help you create a financial plan for your home buying needs and goals. A Roth 401 is an employer-sponsored retirement savings account that is funded with post-tax money. You can withdraw money from 401, but you will incur an early withdrawal penalty of 10% as well as taxes.

FHA Mortgages

Conversely, if the amount you need will have too adverse an affect on your qualification, it might make sense to withdraw the down payment amount and pay the taxes and penalties. Your 401 account may seem tempting as an untapped source of cash, especially if you’re struggling to come up with the money for a down payment on your new home. While this is a viable option, and there are ways to mitigate the penalties, it should only be used as a last resort.

With a Roth 401, you can withdraw the money you’ve contributed at any time tax- and penalty-free. However, if you withdraw earnings on your invested contributions before age 59½, you must pay taxes on them. “I try to tell people, you’re borrowing from your future if you’re doing that,” he says. You can withdraw funds from your 401K account to pay for a primary residence. When you borrow against your 401, you do not get the early withdrawal penalty. You don’t have to pay taxes on the amount you use, either.

Downside of Using Your 401(k) to Buy a House

As mentioned above, this is the less desirable of the two options. Before diving into whether you should use your 401 to buy a house, it’s important to first have a firm grasp on how, exactly, a 401 retirement account works. Once you have a better idea of how much you need to save, it’s time to take advantage of automation.The goal of automation is to take the challenge out of saving. After all, the hardest part is consistently making the choice to put funds away. However, building savings that aren’t automatically taken out of your paycheck is often a bigger challenge.

These folks are part of our Endorsed Local Providers program, so they’re experts in your local market and can help you find the house that suits your family’s needs and budget. And since they’re RamseyTrusted, you can feel confident they’ll serve you the Ramsey way. The only time (italicized—so you know it’s important) it’s okay to consider taking money out of your 401 early is to avoid bankruptcy or foreclosure. Whatever you decide, make sure you consult with a mortgage specialist before committing to an option.

For costs related to the purchase of a principal residence or for tuition for the next year, you’d have to produce the bills. In the case of the natural disaster, you’d have to document the event and the costs to repair the damage to your principal residence. Be sure to research all available options before you withdraw any funds from your retirement account. That way, you’ll keep yourself on the path toward enjoying your golden years in your very own home. You can typically borrow up to half of the vested balance of your 401k, or a maximum of $50,000. Most 401k loans must be repaid within five years, although some employers will allow you to repay a 401k loan over 15 years if it’s used for purchasing a home.

That means that withdrawals are generally only allowed by the IRS after you turn 59 ½, or before 55 if you’ve left or lost your job. Statistically, very few people actually use their 401 to buy a house. If you have an IRA, you should look there for extra funds before considering an early withdrawal from your 401. IRAs are built with special provisions for first-time home buyers, which the IRS defines as anyone who hasn’t owned a primary residence within the previous 2 years. USDA loans allow buyers of modest means to purchase homes in less-dense parts of the country with no money down.

In other words, if you withdraw all of your contributions, you can still withdraw another $10,000 and not pay the 10% penalty or taxes on any of it. If I accept that I will need to pay 10% penalty and also income taxes, what is the best way to get my money out of my 401k? Can I roll it over to a Roth IRA then withdraw whatever I need (I don’t want to borrow, but withdraw with no obligation to repay)?

Some plans allow you to make a hardship withdrawal, and up to $10,000 can be withdrawn tax-free for the express purpose of a first-time home purchase. If you can’t make this due date, then the loan amount becomes a 401 withdrawal in the eyes of the IRS. That means you’ll be subject to income tax and will be required to pay the 10% early withdrawal penalty.

Alternatively, you may be able to take out a loan equal to half your 401K savings or $50,000 . When you take out a loan, you won’t be charged a 10% penalty, nor will 20% in taxes be withheld. To borrow from your 401k loan to finance a down payment, you’ll need to talk to your employer’s benefits office or HR department, or with your 401k plan provider.

You will need to check, however, if your employer offers hardship withdrawals with your plan. They’re not required to offer either loans or hardship withdrawals. Keep in mind that you’ll be deducting mortgage interest on your taxes after you purchase your home. This may actually “wash” with some or all of the income you report from a retirement account withdrawal. I borrowed from my 401k once some years ago to pay college tuition for one of my kids. As I paid down the loan I reckoned this was a not so good deal.

No comments:

Post a Comment