Table of Content

If you don’t have enough for a down payment and closing costs, your best option may be to wait. You can continue saving and looking for other opportunities to grow your income. Consider picking up a side hustle or turning a hobby into a business. Focus on building your credit so you can qualify for a mortgage and get more favorable terms. It is called your 401 because the foundation for this savings plan is the 401K provision in the IRS code.

Our advice is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website. The information provided is not meant to provide investment or financial advice. Using a Roth IRA to help buy a first home can be a smart alternative to borrowing from a 401 that might be beneficial for some home buyers. Unlike 401s, Roth IRA contributions are made with after-tax dollars.

Is using 401k to buy a house a good idea?

Since you’ll be taxed again on withdrawals during retirement, the interest payments will end up being double-taxed. In other words, if you borrow a large amount, the payments could be substantial. If possible, roll over the amount you want to withdraw to an IRA, so you can avoid paying the penalty.

Just like with a Roth IRA, your spouse can also withdraw $10,000 from his or her traditional IRA, so you can collectively obtain $20,000 penalty-free for a down payment if you’re married. The $10,000 limit is a lifetime limit for each individual. The interest rate on 401 loans is typically 1-2% over the prime rate, which is an attractive rate for personal loans and much less than credit card debt.

How Can I Use My 401(k) to Purchase a Home?

Better yet, work with a SmartVestor Pro to make sure your investments are on track to meet your retirement goals. If you are an eligible service member, a veteran or the spouse of one, then a Department of Veterans Affairs loan could be a better alternative to withdrawing from your 401 account. Withdrawing from your 401 account is essentially taking out a loan against yourself. If you want to pay it back, you also need to pay interest, and the time spent paying it back is time that could have been spent on growth. We’ll break down the pros and cons of making a 401 withdrawal for a home purchase, as well as some alternatives. For example, you may be able to put down as little as 3.5% with an FHA loan.

Research what mortgages you may qualify for with lower down payments and whether you’ll qualify for home buying assistance. The federal government has many first-time homebuyer programs with lower minimum down payments and payment assistance programs. You should also check with your state’s local housing authority because each state has unique first-time homebuyer programs. These government-backed mortgages include programs for first-time home buyers and programs that target specific demographics. Even though sometimes it might be less costly to withdraw money from a 401, in many cases, it might be better to use PMI. PMI usually has an annual premium of around 0.5% to 1.5% of the principal amount.

withdrawals for home purchase: Is it possible?

Got a question about the mechanics of investing, how it fits into your overall financial plan and what strategies can help you make the most out of your money? But, “that can be difficult to do if you’re in a time of financial stress,” says David Stinnett, head of strategic retirement consulting for Vanguard. If you need more, apart from the loan you could also make a withdrawal.

Getting a family gift can help you secure a down payment without having to take on unnecessary debt or compromise your retirement funds. It is important to note that the funds from friends and family must be gifted. The funds cannot be loaned or given with the expectation of any kind of financial or physical return. A Roth IRA is a special individual retirement account in which you pay taxes on contributions, and then all future withdrawals are tax-free.

I withdrew money from my IRA to purchase our home and am especially happy since the stock market tanked soon after. The sooner you get into a home, the sooner you can startsaving money on rent and deducting the mortgage interest on your taxes every year. You can also withdraw up to $10,000 without penalty from these accounts for the remodel or repair of a first home.

You’ll enjoy the benefits of homeownership now and can look forward to paying off or selling your home to get ready for your retirement plan. While this option may be less costly than taking out a withdrawal, the interest on your loan repayment will have a cost. Information, rates and programs are subject to change without notice.

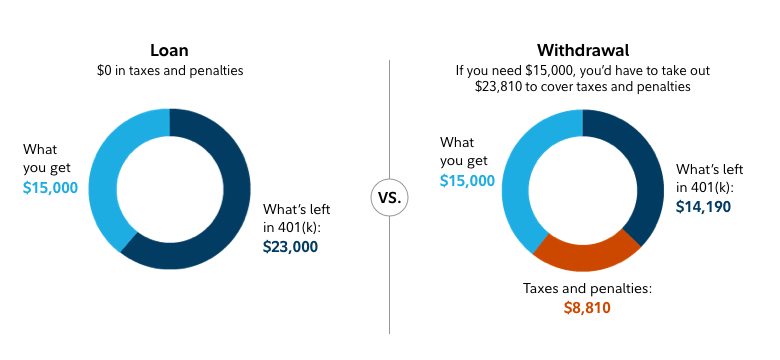

Along with the fee, you’ll need to pay income tax on whatever you withdraw from your 401. So, if you face a 20% income tax on top of the early withdrawal fee, your $10,000 withdrawal just becomes $7,000. When you take out a 401 loan, you do not incur the early withdrawal penalty, nor do you have to pay income tax on the amount you withdraw. A 401 loan must be repaid with interest, but you don’t have to pay income taxes or tax penalties. You’ll want to find out how much you’re able to borrow, the interest you’ll have to pay, and the repayment period. To avoid paying for mortgage insurance, you must make a downpayment of at least 20% of the purchase price of your home.

You can connect with her on her blog Adventurous Adulting. Our free course on buying your first home can help you with each step along the way. Take advantage of our free step-by-step side hustle guide. The other big downside to using your 401k funds to cover a down payment is the lost opportunity to grow your funds. When your funds are safely tucked away in your 401k, it has a few things going in the right direction.

If you decide to leave your employer before repaying your 401 loan, things can get messy. You’ll need to repay the outstanding balance by the tax filing deadline for that year. Unlike the loan, you don’t have to pay this money back to your account, but the withdrawal amount is taxable. However, you will still be liable for the 10% penalty, which is $2,500 in this case. This type of strategy can work for IRA, SIMPLE, and SEP withdrawals as well, but you won’t be liable for the 10% penalty unless you withdraw more than $10,000. If payments are deducted from your paycheck, the principal payments will not be taxed but the interest payments will.

No comments:

Post a Comment